There are many ways you can increase your wealth, but today, we’ll talk about two major investment activities that are available in the market. These are cricket betting and the stock market.

Both of them are major sources of income. When you first think about these, they seem pretty different, but there are some similarities we aren’t aware of. Let’s take a closer look at how cricket betting compares to stock market investing.

What Are The Similarities Between The Stock Market And Cricket Betting?

- Predicting the Future

Both cricket betting and stock market investing involve trying to predict the future. In cricket, you predict the outcome of a match, a specific event within the match, or even a player’s performance.

Similarly, in the stock market, you invest in companies based on your prediction of their growth and profit.

- Risk and Reward

There’s always a risk involved in both activities. In cricket betting, you could lose your bet if your prediction is wrong.

In the stock market, the value of your investments can change, meaning you could lose money if the companies you invest in don’t perform well.

But, there is still some chance to get something. A winning bet or a successful investment can bring a significant return.

- The Excitement of the Chase

Suppose you have ever been involved in betting or the stock market. Watching a cricket match with a bet on it can add a whole new level of suspense and fun.

Likewise, monitoring the stock market and seeing your investments grow can be a thrilling experience, too.

What Is The Difference Between Investing In Stocks And Betting?

Timeframe: This is a major difference. Cricket bets are settled quickly, usually within a few hours or days at most.

Stock market investments, on the other hand, are often for the long term. You might buy shares in a company with the expectation that they’ll grow in value over several years.

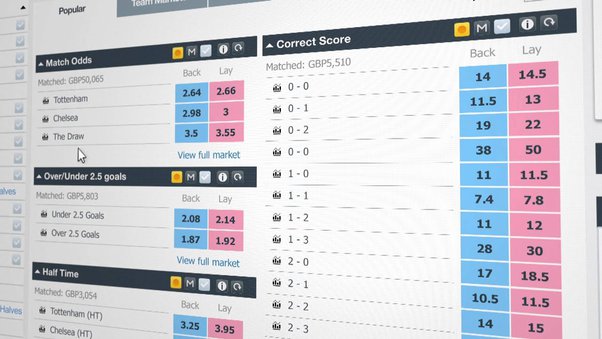

Information and Analysis: Cricket betting relies heavily on analyzing current form, player statistics, pitch conditions, and weather forecasts. The data is always available, and the timeframe is short, allowing for quick decisions.

Stock market investing, however, requires a deeper understanding of financial markets, company analysis, and economic trends.

The information can be more complex, and successful investing often involves a long-term strategy.

Level of Control: In cricket betting, you have some control over your potential return by choosing the type of bet and the odds you accept. However, the outcome of the match ultimately depends on the players’ performances and other factors.

In the stock market, while you choose which companies to invest in, you have little control over external factors that can affect their performance.

Who Should Choose Cricket Betting?

- Cricket fans enjoy the fun of putting their knowledge and predictions to the test.

- Those looking for a quick return on their money with the potential of high rewards.

- People who are comfortable with a higher level of risk and the possibility of losing your bet.

Who Should Choose Stock Market Investing?

People with long-term investment thinking who are comfortable waiting for their investments to grow in the coming years.

Those who enjoy researching companies, understand financial markets, and can develop a strategic investment plan.

People who prefer minimizing risk and are okay with a slower, steadier return.

The Bottom Line is,

Cricket betting and stock market activities are different in one way and similar in other but the good thing is you don’t have to choose one between them.

If you are a cricket fan and know a bit about investment in the stock market, then you choose a platform like Tiger Book, where you can predict matches and enjoy the same feel of the stock market in their cricket trading option.